The pandemic prompted a surge in investment, but is funding reaching those most in need?

The last few years have seen unprecedented challenges for society through the COVID pandemic. Restrictions on normal life, lockdowns, adjustment to a ‘new normal’ - We all still feel the effects of the virus.

A natural consequence of the sudden hyper-focus on attempts to remedy the problems caused and curtail the spread has been increased emphasis on the need for investment in life sciences. In 2020 life sciences companies globally raised £77 billion, a record-breaking total which was quickly superseded by the £133 billion achieved the following year.

In spite of fast-escalating investment, a challenge remains in directing funds in a proportionate manner across the sector, and in start-ups particularly understanding how to go about securing effective backing for their crucial first phases of activity.

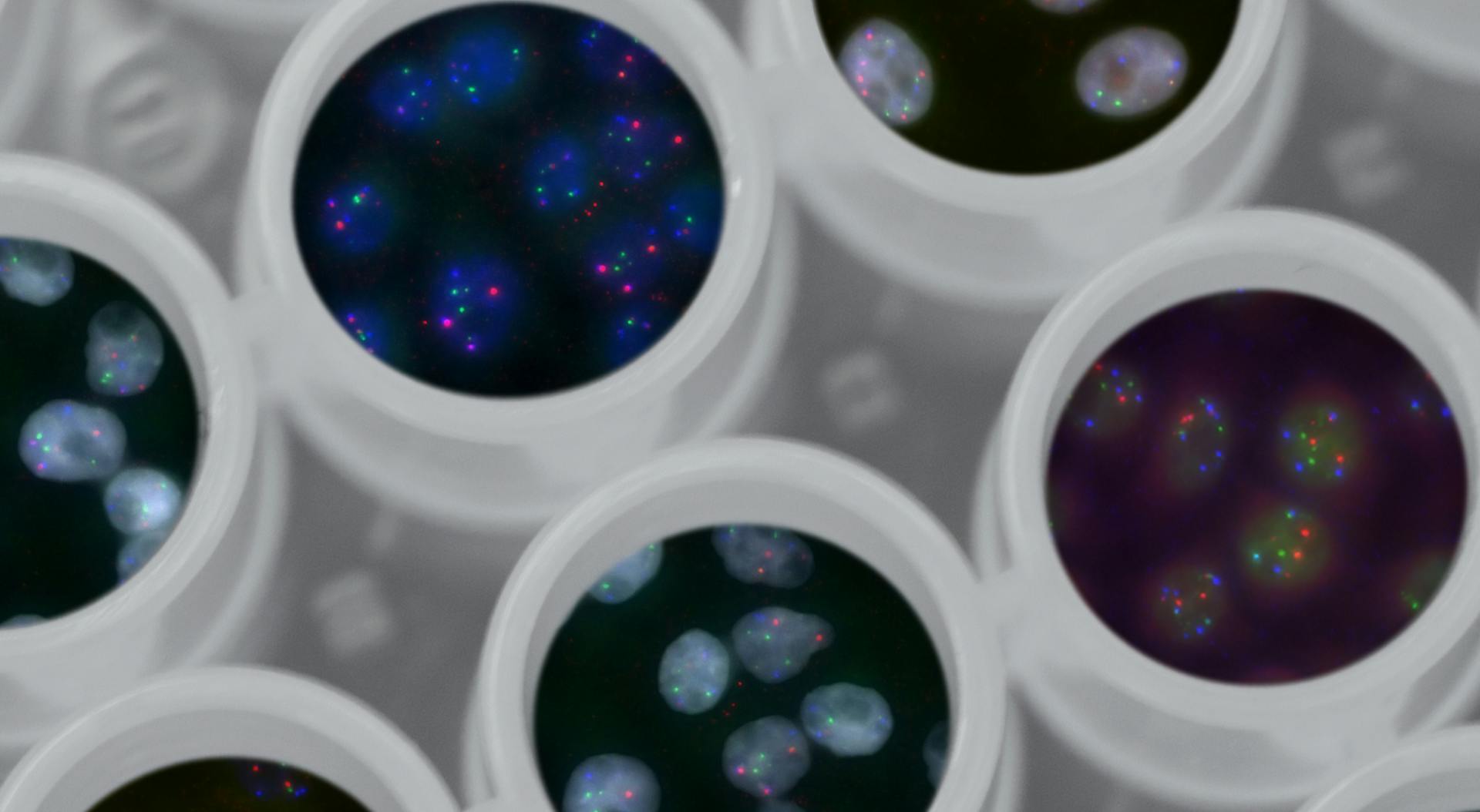

Given the reliance on funding in life sciences - Covering the multiple fields of pharma and biotech, medtech, drug discovery and development services, and digital health and pharmatech - VERB views organisations operating in these areas as falling squarely into our target areas of those underserved by conventional models. The UK Government recently released its Levelling Up White Paper which served to demonstrate the difficulties faced in the UK market, and so our team has asked the question - ‘What specifically can we do to help?’

A targeted and deliberate investment model

Whilst universities are driving the creation of spin-off companies to capitalise on their research and valuable IP, a regularly-encountered issue as we have built relationships with various life sciences organisations is the sheer cost of campus leasing. Space on university campuses comes at a high cost, and represents one of the most prohibitive components of spend for start-ups looking to make the most of their capital.

Our investment model is designed to specifically combat this issue. We work with both new and established occupants of the sector, achieving understanding of specific need and then designing models which specifically address the need to allow them to consolidate and build while we absorb funding risk. This is fundamental to our offer, with an ability to deploy sure and ready capital acting as one of the greatest means of achieving major impact.

Removing geographical barriers

The south east of England has emerged as the epicentre for start-ups in the UK, with further hubs around Bristol and the Midlands. However up to 85% of the total available investment is secured by organisations in London, the south east and east. Our team view this as one of the key areas in which we can leverage our skill and network to drive the growth of fledgling life science - We have placed great emphasis in early conversations on understanding the needs of areas such as the north east of England.

Whilst our established partnerships with land portfolio managers are effective in sourcing land globally, and we are able to effectively serve the traditional hotspots, it is also true that geography should not represent an immediate barrier to investment and success. We do not treat geography as a limiting factor, and have been pleased to develop positive relationships over the last year with a wide variety of organisations both in the UK and across Europe.

Creating and protecting opportunities for both large and small organisations

Leading on from this, and as a critical piece of insight for this sector, a potentially severely-limiting factor is the fact that incubator / accelerator spaces are sometimes occupied in a manner that defies their original intent. Rather than allowing smaller businesses and labs the chance to consolidate and encouraging growth, they become almost completely occupied by single, larger organisations who scale up rapidly and eventually take over entire facilities.

VERB has set out to deliberately, and equally, meet the needs of both ends of this scale. Where small organisations have a need to find their feet as they establish a presence in the market, we enter into agreements which guarantee lease terms, and spaces in facilities which meet the needs of the business at hand. Our capital can as easily be deployed to create multi-tenant incubators as it can for single-tenant, large-scale labs designed to meet the needs of businesses scaling up rapidly or looking to consolidate an increasingly established presence.

The nuances and complex work carried out by those in the Life Sciences sector can only succeed if supported in the right way. Our business takes the important role played in research as a key point of interest, and our investment in the sector is an important contribution in allowing growth in a field where assured financing opens up immense possibility.

* The information contained in this document has been compiled from sources believed to be reliable. VERB do not accept any liability or responsibility for the accuracy or completeness of the information contained herein. And no reliance should be placed on the information contained in this document.

“VERB FOCUS ON LIFE SCIENCE AS MANY OF THOSE IN THE SECTOR LIKELY FEEL UNDERSERVED BY CURRENT INVESTMENT TRENDS - ALL GREAT IDEAS DESERVE THE CHANCE TO GROW AND BE SUCCESSFUL.”